In April, the Treasury Department released rules clarifying requirements for Opportunity Zones, which are part of a relatively new effort meant to drive long-term capital to low-income communities.

People who reinvest their capital gains into Opportunity Funds – which are specialized vehicles dedicated to investing in designated low-income areas – get a tax break.

Are your ears perked up yet?

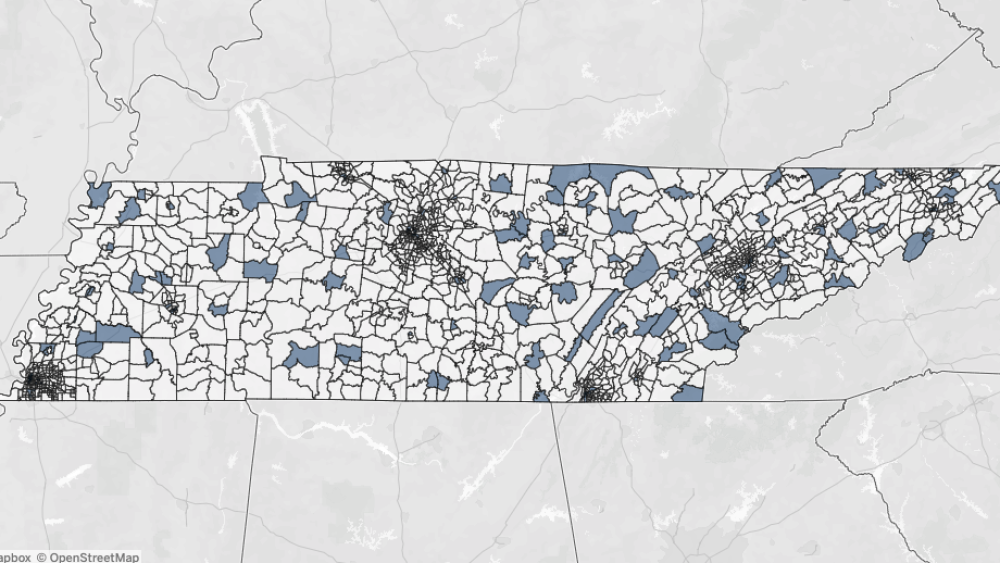

There are seven opportunity zones in Chattanooga + nearly 200 in the state. Here’s the info you need to get started deciding whether this is an investment for you:

Fast facts

- Opportunity Zones are part of 2017’s Tax Cuts + Jobs Act.

- O Funds act as investment vehicles, driving needed cash flow into distressed communities.

- The O Funds activate passive holdings by connecting investors to investment opportunities in “Opportunity Zones.”

- O-zones are low-income areas that are designated by each state based on particular criteria. To receive tax relief, investors may choose to push their realized capital gains into projects or companies within these domestic emerging markets.

But to get the entire tax break, investors have to buy into eligible projects by the end of 2019.

Opportunity Zones in Chattanooga

Seven of the 176 O-Zones in the state are located in Hamilton County.

- Orchard Knob Area

- Riverfront area

- Alton Park

- Near I-24, US-27 split

- Downtown, City Center

- Amnicola area

- UTC area

How Opportunity Funds work

- Investors who sell assets have 180 days to put their taxable capital gains into an approved opportunity fund.

- The fund must hold 90% of its assets in an O-zone located project

- The investor themselves do not need to live in the area.

- Taxes on the original reinvested gain are not due until Dec. 31, 2026, with the taxable gain being cut by 15%.

- The new opportunity investment grows tax-free (like a Roth IRA) as long as it is held for at least ten years.

- A five-year holding increases the rolled-over capital gains basis by 10%.

- A seven-year holding increases the rolled-over capital gain investment basis 5%, for a total of 15%.

How Opportunity Zones are selected

To qualify as an Opportunity Zone the area must meet the following criteria:

- A poverty rate of 20% or higher

- Or a median household income that is less than 80% of the surrounding area

Once the areas have been determined, only 25% of a state’s total tracts are allowed to be designated by Governors as eligible O-zones.

No limits on:

- The amount you can put in.

- How much tax you can avoid.

- The type of tax (whether federal, state, or local) you can avoid.

- How long the proceeds of the reinvested gains can compound tax-free.

What are considered O-zone projects?

O-zone projects can range from farming spaces, mining, energy, data centers, labs, real estate, startups, + venture funds.

Each zone may push certain projects based on the needs of the area (i.e. rural vs. city). For example, for real estate developers, building in an O-zone area offers cheap real estate as well as an unlimited, untaxed upside if the neighborhood continues to grow.

As each O-zone is designated by the area’s mayor, most work to ensure the projects selected are built + serviced by locals, with the town adopting + enforcing zoning and affordable-housing laws as the new cash begins to flow into the community.

Where does TN stand?

- Total tracts in the state: 1,497

- Tracts eligible for O-Zone designation: 810

- Number of tracts approved for O-Zone designation: 176

What does TN hope to accomplish?

The below are the state’s primary areas of focus for the policy:

- Business development and brownfield redevelopment opportunities

- Retail, commercial and tourism development opportunities

- Community and rural development initiatives

- Low-income housing development opportunities

- Proximity to entrepreneur centers, technology transfer offices, and colleges and universities